Almost half of Americans Don’t Know their Credit Score. That shouldn’t be  a surprise when considering employee financial statistics like:

a surprise when considering employee financial statistics like:

28 % have trouble meeting household expenses.

44% say they don’t have at least $2,000 in emergency savings.

Employees stress over personal financial issues can affect their productivity, engagement and lead to illness and absence from work.

Employers should consider the following criteria when looking to offer a financial wellness program:

- Delivered by an unbiased company? Many free or low cost programs have a financial interest to manage employee’s financial assets.

- Content focused on improving financial habits and behaviors.

- Helps employees make informed financial decisions and create strong financial plans.

- Should not cost a fortune. Some programs cost more than $100 per person or double digits per eligible.

Financial wellness is an important dimension of well-being, but a program should be a fraction of the cost of a comprehensive well-being program.

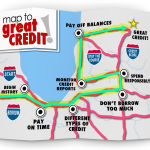

GOOD CENT$ Financial Wellness Program is a six week, self-paced program with video learning modules, validated questions, articles, and helpful tools.

Complete with all the communications including:

-Promotional flyers/posters.

-Program instructions and FAQ’s.

-Outreach email messages.

-Online support group with private Q & A sessions from financial coach.

Contact us learn more about Good Cent$ as a part of your workplace well-being program.